how much federal tax is taken out of my paycheck in illinois

Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. In addition to regular income tax freelancers are responsible for paying the self-employment tax of 153 in 2021.

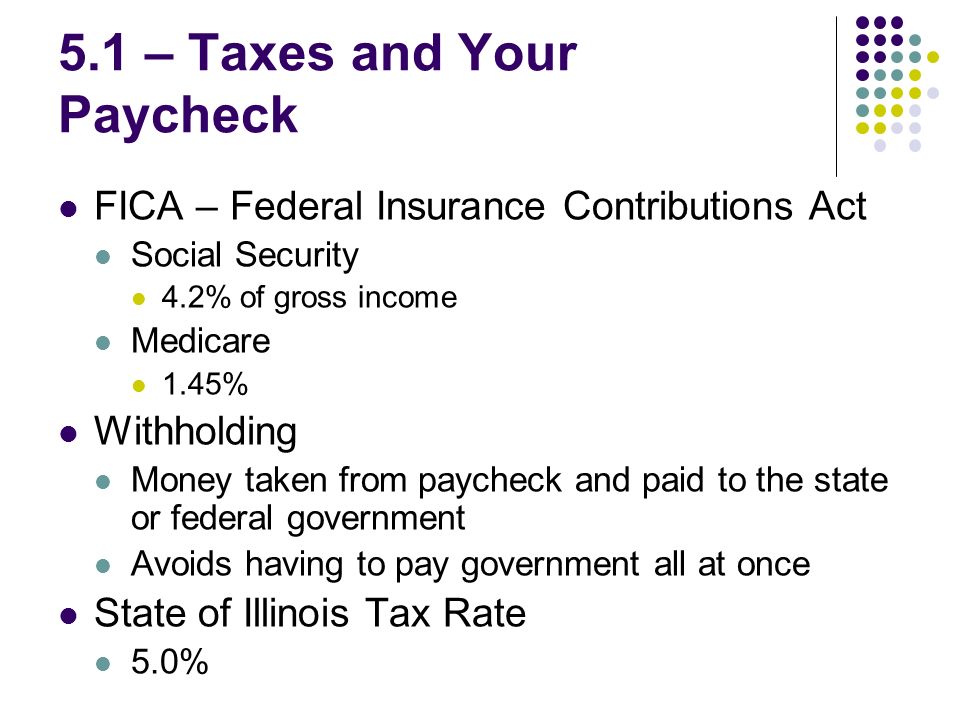

This tax represents the Social Security and Medicare taxes that ordinary employees have taken out of their paychecks automatically.

. When youre self-employed you are your own bosswhich is great news until tax time. Be informed and get ahead with.

State Income Tax Rates Highest Lowest 2021 Changes

Unilife How Much Tax Is Taken Out Of A 600 Paycheck Calculator Without

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Il Il W 4 2020 2022 Fill Out Tax Template Online Us Legal Forms

If A Single Person Made 15 Per Hour And Worked 40 Hours Per Week About How Much Would Their Check Be After Taxes Quora

This Is The Ideal Salary You Need To Take Home 100k In Your State

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Illinois Income Tax Calculator Smartasset

I Have A Monthly Wage Of 1 000 But Need To Pay Tax At 220 So I Just Have 780 In The End Is This Kind Of Tax Rate Common In Illinois Quora

Taxes 5 1 Taxes And Your Paycheck Payroll Taxes Based On Earnings Paid To Government By You And Employer Income Taxes You Pay On Income You Receive Ppt Download

Illinois Income Tax Calculator Smartasset

Unilife How Much Tax Is Taken Out Of A 600 Paycheck Calculator Without

Paycheck Protection Program Accepting New Applications Secretary Of State Urging Online Renewals